ETH Price Prediction: Bullish Convergence of Technical and Fundamental Factors

#ETH

- Technical Momentum Shift - MACD bullish crossover and middle Bollinger Band positioning indicate potential upward breakout

- Institutional Accumulation - ETF inflows and major players targeting significant supply percentages demonstrate strong confidence

- Network Strength - Record transaction volumes and DeFi activity growth provide fundamental support for price appreciation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Reversal Signals

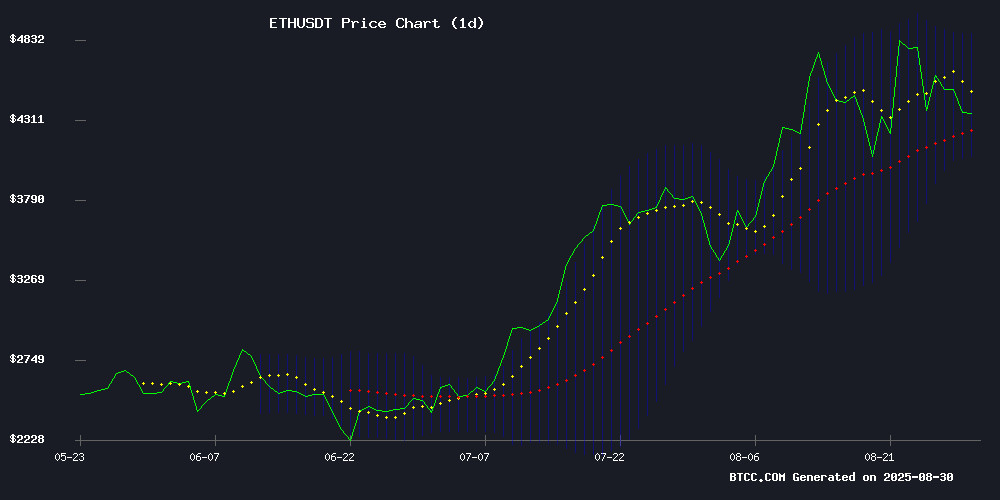

ETH is currently trading at $4,390, slightly below its 20-day moving average of $4,476.46, indicating a minor pullback within an overall positive structure. The MACD histogram at +135.87 shows strengthening bullish momentum as it diverges positively from the signal line. Bollinger Bands suggest ETH is trading in the middle range with support at $4,079 and resistance NEAR $4,874, providing clear levels for potential breakout scenarios.

According to BTCC financial analyst Olivia, 'The technical setup suggests ETH is consolidating before its next major move. The MACD bullish crossover and position within the Bollinger Band middle range indicate accumulation phase characteristics.'

Market Sentiment: Institutional Demand Reaches Unprecedented Levels

Ethereum network activity has reached all-time highs with record transaction volumes, while institutional inflows through ETFs continue to demonstrate strong demand. Uniswap's DEX volume surge to $164 billion weekly highlights robust DeFi activity, and BitMine's aggressive accumulation strategy targeting 5% of circulating supply indicates significant institutional confidence.

BTCC financial analyst Olivia notes, 'The convergence of institutional ETF flows, record-breaking network activity, and major players accumulating ETH creates a fundamentally strong backdrop that supports the technical bullish outlook.'

Factors Influencing ETH's Price

Ethereum Demand Climbs As Monthly Transactions Hit New All-Time High

Ethereum faces selling pressure after an 11% retrace from recent highs, testing investor resolve. Despite the pullback, on-chain activity continues to expand, with monthly transactions reaching a record high. Analyst Ted Pillows highlights sustained adoption across DeFi, NFTs, and other applications.

The divergence between price volatility and network strength suggests Ethereum's long-term trajectory remains intact. Key demand levels will determine short-term direction as the market digests the correction.

Uniswap Leads DEX Surge as Weekly Trading Volume Tops $164 Billion

Decentralized exchanges are gaining ground in the crypto ecosystem, with weekly trading volume surging 21% to $164.79 billion. Uniswap maintains its dominance, recording $35.18 billion in weekly volume and $3.60 billion in total value locked.

PancakeSwap solidifies its position as the second-largest DEX, processing $15.37 billion in weekly trades on the BNB Chain. The sector now commands 17% of overall crypto exchange volume, signaling growing investor preference for decentralized platforms.

Ethereum ETFs Drive Institutional Inflows as Analysts Eye Presale Opportunities

Ethereum surged past $4,600 amid robust institutional demand, with U.S. spot ETFs recording $444 million in net inflows during the latest trading session—nearly double Bitcoin ETF inflows. Fidelity's FETH attracted $129 million, while BlackRock's ETHA led with $314 million. Total assets under management for ethereum ETFs now approach $13 billion since launch, signaling strong conviction in ETH's long-term fundamentals despite recent volatility.

Analysts suggest the ETF momentum may foreshadow altcoin rallies, with presale projects like MAGACOIN FINANCE gaining attention as potential beneficiaries. ETH's 71% annual gain contrasts with its brief dip to $4,413, underscoring institutional 'buy-the-dip' behavior. The divergence between ETF inflows and spot price fluctuations reflects deepening institutional engagement with Ethereum's ecosystem.

Ethereum Network Activity Hits Record Highs Amid Price Volatility

Ethereum's network activity surged to unprecedented levels in August, with total transactions exceeding 1.7 million for the first time. The 14-day EMA for active addresses reached a three-year peak, signaling broad-based participation rather than concentrated speculation.

Despite the network strain, transaction fees remained subdued—a lingering effect of March's Dencun upgrade. Decentralized exchange volumes and total value locked are now testing 2021 bull market thresholds, though ETH's price slipped below $4,400 amid the activity spike.

The asset faces a critical technical test at an ascending trendline NEAR $4,000. A breach could trigger liquidations, though the fundamental backdrop—record usage coupled with contained costs—paints a bullish structural case for ETH's medium-term trajectory.

BitMine's Aggressive Ethereum Accumulation Targets 5% of Circulating Supply

Ethereum has emerged as a standout performer in recent months, outpacing Bitcoin with unexpected bullish momentum. Behind this surge lies an unprecedented buying spree by BitMine, a publicly traded firm now holding billions in ETH reserves.

The company's strategy, dubbed 'the alchemy of 5%' by chairman Tom Lee, aims to secure a $27 billion stake in Ethereum's circulating supply. Since June 2025, BitMine has deployed $750 million across two private raises, amassing over 1.15 million ETH worth nearly $5 billion by early August.

This positions BitMine as the world's largest publicly traded Ethereum treasury holder—a calculated move signaling institutional conviction in ETH's long-term value proposition.

Ethereum At The Core: Where Every Major Crypto Trend Converges

Ethereum has solidified its position as the backbone of innovation in the digital asset space, serving as the foundational LAYER for nearly every transformative trend in crypto. Its role as the essential infrastructure is accelerating adoption and powering the future of global digital markets.

SharpLink Gaming's recent commentary highlights ETH not merely as a token but as the reserve asset of the on-chain economy—a cornerstone of the future digital financial system. The company's strategic accumulation of ETH reflects a broader conviction in Ethereum's enduring network effects and its centrality to decentralized finance.

Market dynamics suggest ETH's price could see upward pressure as demand grows. Analyst Daan crypto Trades notes Ethereum recently tested its 2021 all-time high, a milestone often marked by volatility in crypto markets.

Linea Airdrop Checker Live Soon: LXPxLAM Tokens Minted, TGE Nears

Ethereum's Layer 2 project Linea is gearing up for a significant milestone with the imminent launch of its airdrop checker. The LXPxLAM tokens have already been minted, signaling that the Token Generation Event (TGE) is on the horizon.

This development marks a pivotal moment for Linea, which has been one of the most watched Layer 2 solutions in the Ethereum ecosystem. The airdrop could catalyze further adoption and liquidity for the project.

Ethereum Shatters On-Chain Records Amid DeFi and Institutional Surge

Ethereum has achieved unprecedented on-chain activity in August 2025, with decentralized exchange volume soaring to $135 billion and total transactions hitting 48 million. The network's resurgence is fueled by a combination of revitalized DeFi participation and institutional inflows, pushing total value locked (TVL) to a record $240 billion.

Spot Ethereum ETFs in the U.S. have absorbed nearly $10 billion in inflows since July, contributing to the bullish momentum. Transaction fees have plummeted, further accelerating adoption. Bloomberg ETF analyst James Seyffart notes total ETF flows since launch now stand at $13 billion, representing 5.4% of Ethereum's market capitalization.

APT Miner Gains Traction as Ethereum Volatility Spurs Demand for Stable Mining Solutions

Ethereum's recent all-time high has drawn global attention, but its accompanying volatility is pushing investors toward more stable alternatives. APT Miner, a cloud mining platform, is emerging as a preferred choice with its automated contract model that eliminates the need for physical mining equipment or technical expertise.

The platform's "contract-to-earn" system settles within 24 hours and returns principal upon expiration, leveraging Bitmain and Shenma mining machines paired with intelligent scheduling for consistent output. Since its 2018 UK registration, APT Miner has prioritized compliance, amassing 9 million users and deploying hundreds of clean-energy mining farms powered by solar and wind.

Investors are drawn to its streamlined interface and green energy alignment—a hedge against both market swings and environmental scrutiny. As crypto markets mature, automated solutions like APT Miner may redefine risk management for retail participants.

Ethereum Price: The Bright Future of Digital Finance

Ethereum continues to dominate the cryptocurrency market, with its price hovering above $4,200 as of August 20, 2025. Institutional interest and strong demand underscore its resilience, even amid broader market corrections. Unlike Bitcoin, which is often seen as digital gold, Ethereum's utility extends to decentralized finance (DeFi), smart contracts, and NFTs, solidifying its role as a foundational asset in the digital economy.

Hashj Cloud Mining has launched Ethereum mining services, offering investors a streamlined way to generate passive income. The platform provides tools to monitor and analyze price fluctuations, enabling users to craft strategic investment approaches. Early adopters can sign up at www.Hashjcloudmining.io to receive a $118 bonus.

Ethereum Foundation Overhauls Grants Program, Pauses Open Applications

The Ethereum Foundation has temporarily suspended its open grants program as it restructures the Ecosystem Support Program (ESP). Since 2018, the initiative has distributed over $3 million in funding to 105 projects, spanning developer tooling, research, and community events.

ESP's lean team cited overwhelming inbound applications as a bottleneck, diverting resources from strategic opportunities. The pause aims to streamline operations and refocus on high-impact ecosystem development.

Is ETH a good investment?

Based on current technical indicators and fundamental developments, ETH presents a compelling investment opportunity. The combination of strong institutional demand through ETFs, record network activity, and positive technical momentum suggests potential for upward price movement.

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | $4,390 (-1.9%) | Neutral |

| MACD Histogram | +135.87 | Bullish |

| Bollinger Position | Middle Range | Consolidation |

| Institutional Flow | Strong ETF Demand | Very Bullish |

| Network Activity | All-Time High | Bullish |

BTCC financial analyst Olivia emphasizes that 'current levels offer attractive entry points for long-term investors, though short-term volatility should be expected given the cryptocurrency's inherent nature.'